The College Money Talk: A Parent’s Guide to Navigating Financial Strategy with Confidence

This is a subtitle for your new post

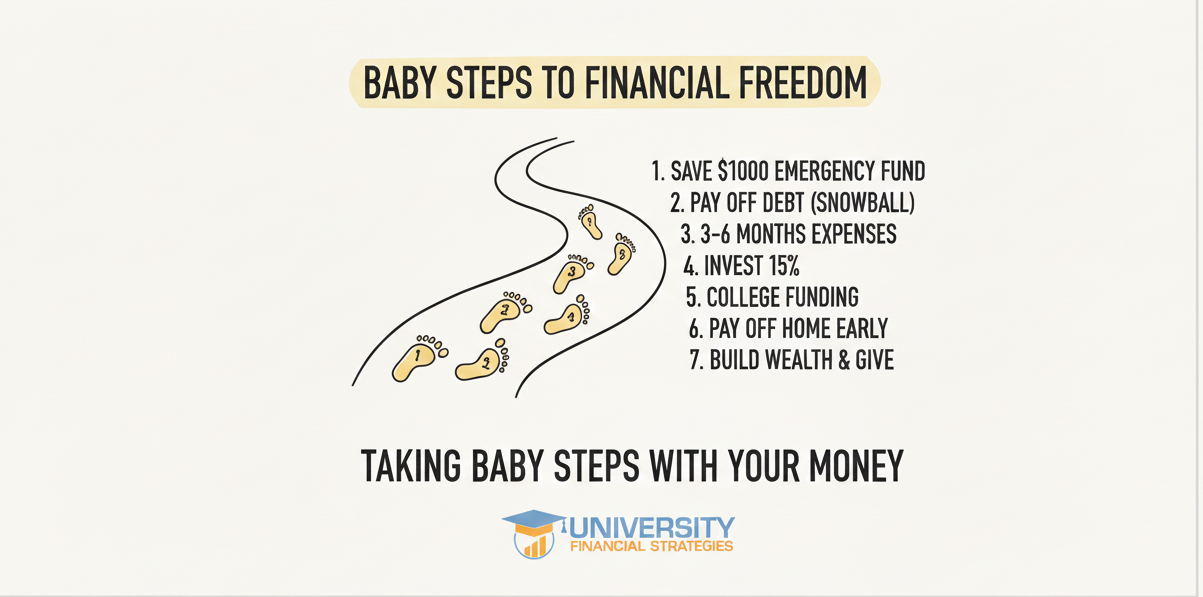

Paying for college can feel like navigating a minefield, but the right approach changes everything. Forget the old-school method of just saving in a 529 plan and relying on loans. It’s time to shift gears and embrace a comprehensive financial strategy that includes cash flow management, tax planning, and debt discipline. The essential first step? Have the all-important money talk with your child before the college search kicks off. This conversation sets the stage for smart decisions, avoiding heartache over unaffordable dream schools.# The College Money Talk: A Parent’s Guide to Navigating Financial Strategy with Confidence

Effective college financial planning requires a comprehensive approach. Let’s explore key strategies to help you and your child make informed decisions.

The Essential Money Talk

Having an open conversation about college finances is crucial. This talk sets the foundation for realistic expectations and smart choices.

Start by being transparent about your financial situation. Share the amount you’ve saved in 529 plans and other accounts.

Next, discuss the potential financial gap. Be clear about how much your child might need to cover through work, scholarships, or loans.

Encourage your child to take ownership of their education costs. This fosters financial responsibility and helps them understand the value of their degree.

Understanding Cash Flow Management

Effective cash flow management is key to college financial planning. It’s about making your money work efficiently over the college years.

Consider using tools like Monarch Money to get a clear view of your family’s finances. This can help you identify areas where you can redirect funds towards college expenses.

Remember, college is a multi-year expense. Plan for consistent cash flow rather than viewing it as a one-time cost.

Look for ways to increase income or reduce expenses. Every dollar saved is one less dollar borrowed.

Considering Smart Alternatives

College planning isn’t always about traditional four-year universities. There are many paths to a successful career and financial future.

Consider starting at a community college. This can significantly reduce costs for the first two years of higher education.

Trade schools and vocational programs offer focused, often shorter-term education leading to well-paying careers.

Online degree programs can offer flexibility and potential cost savings, especially for students who need to work while studying.

Effective Budgeting for College

Budgeting is a critical skill for both parents and students. It helps manage expenses and avoid unnecessary debt.

Tracking and Budgeting Tools

Using the right tools can make budgeting for college much easier and more effective.

Monarch Money is an excellent tool for tracking expenses and creating a budget. It allows you to connect all your accounts for a comprehensive financial view.

Create categories for college-related expenses. This helps you understand where money is going and where you can cut back.

Regularly review your budget and adjust as needed. College expenses can change, so flexibility is key.

Setting Clear Financial Goals

Setting specific, measurable goals is crucial for successful college financial planning.

Start by determining the total cost of attendance for your chosen schools. Include tuition, room and board, books, and other expenses.

Break down this total into yearly and monthly savings goals. This makes the overall cost feel more manageable.

Consider using +CAP to help set realistic goals based on your financial situation and college choices.

Strategic Tax Planning for Families

Smart tax planning can significantly reduce the overall cost of college. Let’s explore some key strategies.

Leveraging 529 Plans and Credits

529 plans offer tax-free growth for college savings, making them a powerful tool in your financial strategy.

Contributions to 529 plans grow tax-free, and withdrawals for qualified education expenses are also tax-free.

Some states offer additional tax benefits for 529 plan contributions. Check your state’s rules to maximize these benefits.

Don’t forget about education tax credits like the American Opportunity Tax Credit (AOTC) and Lifetime Learning Credit. These can provide significant tax savings.

Understanding Student Loan Deductions

Student loan interest deductions can offer some tax relief after graduation.

Students can deduct up to $2,500 of interest paid on qualified student loans each year. This deduction is taken as an adjustment to income, so you don’t need to itemize to claim it.

Be aware of income limits for this deduction. As of 2023, the deduction starts to phase out for incomes above $70,000 (single) or $145,000 (married filing jointly).

Keep good records of all student loan interest paid. You’ll need this information when filing taxes.

For more detailed information on financial planning for college, check out this comprehensive guide for parents.

Remember, effective college financial planning is about more than just saving money. It’s about creating a comprehensive strategy that considers all aspects of your family’s financial situation. For personalized advice, consider consulting with a financial advisor who specializes in college planning.

For visual learners, this YouTube video offers additional insights into college financial planning strategies.